SPOTLIGHT ON PLANNING FOR CHANGE

-

Sending scouts to the future to create strategic options

BY DR SHAWN CUNNINGHAM

28 AUGUST 2025Do you sometimes feel like you’re constantly on the back foot as surprise after surprise disrupts your plans? Are you continually having to shuffle your priorities, meaning that your long-term strategies are put on hold as you face more immediate challenges? Sometimes these surprises might even feel like déjà vu, because you might have sensed something was coming but did not think it was so imminent that you had to confront it.

Read More

- 1

ABOUT THE TECHNOLOGICAL CHANGE PROJECT![]()

The Technological Change and Innovation System Observatory project aims to track and create awareness of disruptive innovation and discontinuous technological change by organisations in the public, private and not-for-profit sectors.

PROFILING TECHNOLOGIES

AT THE FRONTIER

AT THE FRONTIER

-

LARGE LANGUAGE MODELS LIKE CHATGPT AND THE WORKPLACE

TECHNOLOGY PROFILE 6

Artificial intelligence in the form of ChatGPT was a massive and almost instant phenomenon. One year ago – in November 2022 – OpenAI released its ChatGPT model on the internet. Within only a few days, the model had been tried by more than one million users. The release of this chatbot caught OpenAI’s competitors off-guard, and many companies had to scramble to get competing products launched.

Unfortunately, the media hype generated by the rapid uptake might have caused some decision-makers to ignore paying more attention to the rapid developments in the generative artificial intelligence landscape.

It would be a mistake for decision-makers to allocate the developments in the AI field to the IT department. These developments can change how data is used and decisions are made. Even the current AI tools enable manufacturers to unlock their data and integrate diverse business areas like logistics, manufacturing, customer service, and more.. -

ROBOTICS IN THE MANUFACTURING SECTOR

TECHNOLOGY PROFILE 5

A robot is a programmable machine that can complete a task typically performed by a human. Robots have different levels of autonomy, ranging from human-controlled to autonomous bots that perform tasks without external influence. The field of study focused on developing robots and automation is called robotics.

A robot is a programmable machine that can complete a task typically performed by a human. Robots have different levels of autonomy, ranging from human-controlled to autonomous bots that perform tasks without external influence. The field of study focused on developing robots and automation is called robotics.

Industrial robots are typically seen as a replacement for labour, while collaborative robots, or cobots, possess the innate ability to work in tandem with humans. -

AUGMENTED REALITY IN THE MANUFACTURING SECTOR: TECHNOLOGICAL NOVELTY OR MERIT

TECHNOLOGY PROFILE 4

Augmented reality (AR) technology allows digital content to be overlayed or superimposed onto the real world. AR is only partially immersive as digital content is integrated as a layer onto the real world, whereas virtual reality is closed and fully immersive. The costs of applying augmented reality are much lower than the costs of virtual reality because AR typically combines a visual feed with a data layer; it does not involve the creation of a complete virtual world.

Augmented reality (AR) technology allows digital content to be overlayed or superimposed onto the real world. AR is only partially immersive as digital content is integrated as a layer onto the real world, whereas virtual reality is closed and fully immersive. The costs of applying augmented reality are much lower than the costs of virtual reality because AR typically combines a visual feed with a data layer; it does not involve the creation of a complete virtual world.

A major benefit of AR is that it reduces users’ cognitive load and provides technical staff access to relevant (and digitally updated) records, data and information. -

INFORMATION PROCESSING: ARTIFICIAL INTELLIGENCE, MACHINE LEARNING AND BIG DATA

TECHNOLOGY PROFILE 3

Artificial intelligence (AI) can be described as the ability of digital systems to acquire and apply knowledge, and to autonomously execute tasks associated with intelligent beings. This includes a variety of cognitive tasks such as sensing, processing, language, reasoning, learning or even making decisions or self-correcting. AI combines sophisticated hardware and software with elaborate datasets and knowledge-based processing models to demonstrate characteristics of effective human decision-making.

It would be a mistake to think of AI as a technology of the future, because it is already used in our smartphones, on websites, in aircraft, for traffic navigation, in the finance sector, and increasingly in manufacturing. -

THE INTERNET OF THINGS

TECHNOLOGY PROFILE 2

Over the past 10 years, the Internet of Things (IoT) has slowly crept into the daily lives of consumers through smartwatches, vehicle tracking systems, public transport apps, home alarm systems and food delivery services. These technologies offer many conveniences, such as tracking transport schedules, parcel deliveries, the location of assets like vehicles, or local weather conditions. It takes existing expert domains, such as smart factories, process automation, flexible manufacturing and process control, and combines these with the extensive reach of internet and telecommunication technologies.

Over the past 10 years, the Internet of Things (IoT) has slowly crept into the daily lives of consumers through smartwatches, vehicle tracking systems, public transport apps, home alarm systems and food delivery services. These technologies offer many conveniences, such as tracking transport schedules, parcel deliveries, the location of assets like vehicles, or local weather conditions. It takes existing expert domains, such as smart factories, process automation, flexible manufacturing and process control, and combines these with the extensive reach of internet and telecommunication technologies.

For industry, the Industrial Internet of Things (IIOT) offers increased oversight and connectivity between different manufacturing and business processes, and closer integration with suppliers, logistics providers, warehouses, and even clients. It allows for improved efficiency and better analysis of process flows, often over large distances. At the same time, it allows for new services to be offered to clients such as predictive mainte-nance, management systems, analytical services and software updates.

At the heart of IoT technology is the capability to integrate the data streams from distributed sensors into management systems and user interfaces. While some sensors mainly collect and transmit data, other sensors could be programmed to automatically trigger programmed functions. As these different sensors and devices perform their functions, rich data is collected that allows for improved process management and efficiency, data analysis and value to be offered. -

Additive manufacturing: 3d and 4d printing

TECHNOLOGY PROFILE 1 (Updated April 2022)

Additive layer manufacturing describes a manufacturing process in which a digitally controlled head with a laser deposits a fine layer of raw material to construct a three-dimensional object. Additive manufacturing is sometimes also called 3D printing.

Additive layer manufacturing describes a manufacturing process in which a digitally controlled head with a laser deposits a fine layer of raw material to construct a three-dimensional object. Additive manufacturing is sometimes also called 3D printing.

3D desktop printers are already available to consumers at computer retailers and hobby shops. The performance and functionality of desktop 3D printers are increasing rapidly, while the cost of ownership is falling rapidly. Desktop 3D printers usually deposit a layer of molten plastic on a bed to create a three-dimensional shape.In the industrial domain, rapid advances are being made in the melting of metals, alloys, high performance plastics and polycarbonates using lasers. Likewise, in the medical field, different technologies are being developed that allow for the combination of cells, growth factors, biomaterials and tissue to grow organs. Additive manufacturing technologies are also used to print complex sand moulds, or to create wax moulds for investment castings. The metal objects made by 3D printed moulds are basically ready-for-use and require almost no further grinding or processing.

-

JENDAMARK AUTOMATION

COMPANY PROFILE 5

Jendamark Automation, based in Gqeberha, was the brainchild of Eastern Cape-born Quinton Uren who started working out of a garage in 1989. More than 30 years on, with Uren at the helm together with three other directors, Jendamark has grown from three employees to well over 700 worldwide. This homegrown company from the Eastern Cape now has a production facility in India and sales offices in Germany and the United States, and has become a global player delivering turnkey production line solutions to some of the world leading automobile manufacturing companies.

Read More -

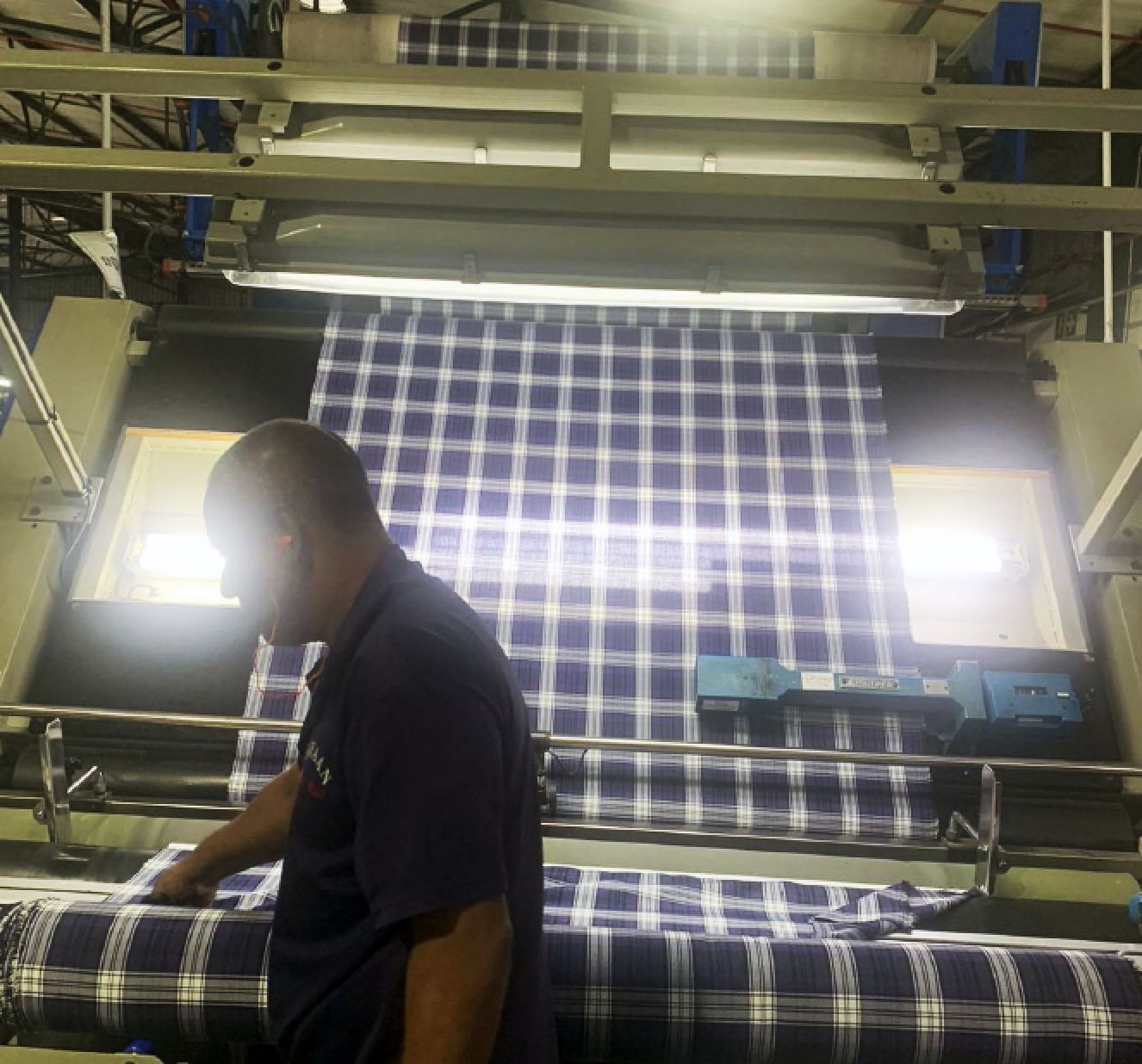

IMRAAN TEXTILE MILLS

COMPANY PROFILE 3

Imraan Textile Mills – which produces woven fabric mainly for the local apparel market – is located in the hills of Mtwalume on the South Coast of KwaZulu-Natal. The Bux family became a minority shareholder of the company on the eve of the new democracy in 1994. Within a matter of years, the company, like many other textile mills, faced intense competition from the influx of cheaper imported clothing as the economy opened up to international competition in the post-1994 period. While the small-fledging company survived in part through the use of new technologies, many others closed their doors.

Imraan Textile Mills – which produces woven fabric mainly for the local apparel market – is located in the hills of Mtwalume on the South Coast of KwaZulu-Natal. The Bux family became a minority shareholder of the company on the eve of the new democracy in 1994. Within a matter of years, the company, like many other textile mills, faced intense competition from the influx of cheaper imported clothing as the economy opened up to international competition in the post-1994 period. While the small-fledging company survived in part through the use of new technologies, many others closed their doors. -

HI-ALLOY CASTINGS

COMPANY PROFILE 2

Foundries are traditionally depicted as being dirty, dark and dangerous but the current General Manager of Hi-Alloy Castings, Dalmari Mc Queen, is focused on transforming the company into a “foundry of the future” which is digital, intelligent, clean and green. Mc Queen is an industrial engineer who has a long history of working and consulting in the foundry sector..

Foundries are traditionally depicted as being dirty, dark and dangerous but the current General Manager of Hi-Alloy Castings, Dalmari Mc Queen, is focused on transforming the company into a “foundry of the future” which is digital, intelligent, clean and green. Mc Queen is an industrial engineer who has a long history of working and consulting in the foundry sector.. -

PRESTIGE CLOTHING TFG

COMPANY PROFILE 1

At first glance on entering the Prestige Clothing TFG factory in Epping, Cape Town you get a sense of a traditional clothing manufacturing company. However, beyond the rows of machinists you get a glimpse of a different world emerging – a world of automated cutting machines, automated stitching machines, and increased digitalisation. It is these technological advances that have contributed to the success of this operation.

At first glance on entering the Prestige Clothing TFG factory in Epping, Cape Town you get a sense of a traditional clothing manufacturing company. However, beyond the rows of machinists you get a glimpse of a different world emerging – a world of automated cutting machines, automated stitching machines, and increased digitalisation. It is these technological advances that have contributed to the success of this operation.

- 1

POLICY BRIEFS

AND RESEARCH PAPERS

AND RESEARCH PAPERS

-

Technological change and industrial policy

These research papers and policy briefs focus on preparing South African industry for the fourth industrial revolution.

RESEARCH PAPER

Strengthening the distributed technological intelligence of industries in South Africa

Organisations have to confront new technologies, or they might be disrupted when new technologies exceed the performance and functions of their current core competencies. Observing global technology developments is hard for any organisation to do alone, especially when potentially valuable or disruptive technologies may be developed in the obscurity of niche markets. Anticipating the potential of these technologies is important, and strategies need to be adjusted to develop new competencies, adjust existing competencies, and reconfigure the business model as the organisation learns about the possibilities of the new technology. As industries, technologies, supporting organisations and broader institutions co-evolve, it is not sufficient for a few companies to individually embrace new technologies. Competing with new technologies in new markets often requires complementary investments and co-specialisation beyond any given firm to be developed. Therefore, it is necessary to get more companies and their supporting organisations to develop a shared or distributed sense of key technological developments and what future investments and competencies are needed.

This paper considers two frameworks that TIPS could use to support industry collectives and their supporting organisations in strengthening their collective Technology Intelligence to coordinate strategic responses to emerging technology and market opportunities.

POLICY BRIEF

Adoption of frontier technologies in six manufacturing subsectors

This policy brief highlights the adoption of frontier technologies in six manufacturing subsectors: metal and engineering; retail motor and aftercare; plastics; manufacturing; automotive components; automotive manufacturing; and new tyre manufacturing. This is important because, while there is an understanding of the importance of frontier technologies for the manufacturing sector, there has not been a comprehensive investigation of the level of adoption across the different subsectors. Previous research has either zoned in on one sector, such as metal, or looked at the level of adoption at the continental level. To address the gap, a survey was conducted on behalf of merSETA (the Manufacturing, Engineering and Related Services Sector Education and Training Authority) to collate baseline information on key trends around technological change. This policy brief highlights the aggregated results from the survey. The survey analysis is supplemented by interview data with key stakeholders in the industry.

POLICY BRIEF

Technological change and the DTIC: innovation in the industry

The rapid pace of technological change is taking place in the context of South Africa slipping in its readiness for these changes. At the same time policies to support structural economic change in the economy, such as moving from a dependence on mining and commodities, are being implemented. Technological change and innovation are important elements of this structural change. This Policy Brief aims to give context to these technological changes and the industrial policy interface.

RESEARCH REPORTS

- Framing the concepts that underpin discontinuous technological change, technological capability and absorptive capacity

This paper takes the form of a literature study on the topic of technological change, innovation and building technological capabilities. - World Economic Forum and the fourth industrial revolution in South Africa

This paper focuses on the fourth industrial revolution and the concept as promoted by the World Economic Forum, international consultancies, governments and multinational firms. - Mapping the meso space that enables technological change, productivity improvement and innovation in the manufacturing sector

This paper focuses on meso organisations and policies that strengthen the technological capability of the country or an industry to enable change, adaptation and economic resilience. - Technological change and sustainable mobility: An overview of global trends and South African developments

This paper focuses on technological change and the developments in the sustainable mobility topic in South Africa.

- Framing the concepts that underpin discontinuous technological change, technological capability and absorptive capacity

- 1

OTHER

PUBLICATIONS

PUBLICATIONS

-

WEF Top 10 Emerging Technologies of 2025

REPORT BY THE WORLD ECONOMIC FORUM

Remarkable innovations emerge from research labs every year, creating unprecedented opportunities to address humanity's greatest challenges.

The Top 10 Emerging Technologies of 2025, developed in collaboration with Frontiers, highlights 10 innovations with the potential to reshape industries and societies. Based on expert nominations and rigorous foresight evaluation, the report spans from structural battery composites and engineered living therapeutics to osmotic power and AI-generated content watermarking. Each entry explores scientific progress, strategic impact, and ecosystem readiness across five dimensions.

The findings provide leaders with a forward-looking lens to harness transformative technologies for sustainable growth, resilience and inclusive innovation. -

South Africa's National AI Policy Framework (2024)

The National AI Policy Framework aims to integrate AI technologies to drive growth and enhance social well-being. It's core objective is to foster a robust AI ecosystem through coordinated research and development, talent cultivation and infrastructure investment.

The framework was released in October 2024 by the Department of Communications and Digital Technologies.

-

The 2024 South African Science, Technology and Innovation Report

Published by the National Advisory Council on Innovation.

The 2024 Science, Technology and Innovation (STI) report monitors the annual performance of the South African National System of Innovation (NSI).

This is achieved by consolidating STI data from reliable local and international sources. Where possible, drivers of observed trends are identified. This report aims to stimulate further investigation/research on selected topics of national interest.

- 1